This article will take you through the Tala loan review.

Tala is a town in Kenya:) Yes, it is, but the Tala I am referring to is a mobile loan application that instantly allows you to get a loan on your mobile phone straight to M-Pesa.

Shivani Siroya, the Company CEO, founded the Fintech Company behind the Tala loan app. The company is based in Santa Monica, California. It does not only operate in Kenya but also in Mexico, the Philippines, and India.

How do I apply for a Tala loan?

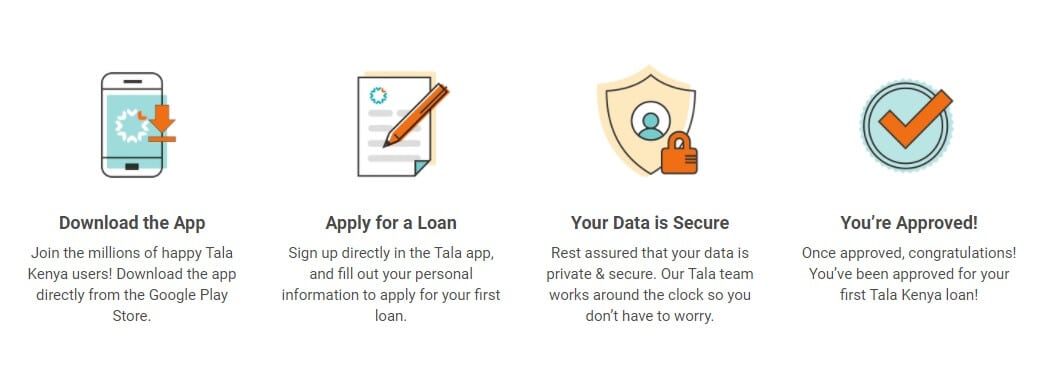

As you can see from the image above, the tala mobile app works on Android-enabled phones.

The Tala loan application process is simple like this:

Step 1: Download Tala App

Visit the Google Play Store and download the app to your phone. To complete this task, you must be connected to the internet and have an M-Pesa-activated phone number.

Step 2: Fill Tala loan application form

The next step is for you to sign up in the Tala app. The required information is personal information which Tala uses as “security.”

Step 3: Apply for a Loan

After registering, you can apply for your loan. You don’t have to wait but go ahead and apply.

The best thing is you will know if you qualify or not. If you are eligible for the loan, the money will be disbursed to your M-Pesa in less than a minute.

How Much Money Can I Borrow?

If you qualify for the first time, you can get from as low as KES 1,000 to around KES 5,000, depending on your M-Pesa statement.

The first time the loan amount is tiny, you are encouraged to make timely repayment to qualify for more the next time you borrow.

The maximum you will ever get from the Tala app is KES 30,000. This is after several successful repayments on time.

What are Tala Kenya Loan Interest Rates and Terms?

Tala says they don’t charge interest fees on their loans but have a Service Fee for each loan you take.

This ‘Service Fee’ depends on the type of loan you take. They offer a 30-day loan and a 21-day loan which you choose, and these are the different service fees charged:

- 5% to 14% for loans within 21 days.

- 7% to 19% for loans within 30 days.

Tala Kenya Review

Now that you know more about Tala App, let me give you my review. This is based on my experience, and if you have a different experience, please let me know in the comments below.

I must say I like it and have not had any issues.

The process is smooth and easy for anyone with a mobile phone, from downloading to applying for the first loan to repay the loan. It is easy, and you can do it on your phone.

I like it most because it shows you how much you qualify for and how much you will repay right from the beginning.

It also tells you what information it will collect on your phone and asks for your permission to do this.

I have not contacted Tala App support, but I find the FAQ section quite detailed and helpful. This is a smart move where the many questions you have about the app are answered right there in the app.

We have a support group for loan borrowers in Kenya on Facebook, and Tala was rated as the most-used app in a mini-poll we ran on the group.

I wouldn’t say I liked Tala because they asked questions every time I needed to get a loan. But it is pretty short, and I always finish it in a second.

I delayed repaying my loan at once and got constant messages and calls, which was irritating. You will be called and texted regularly until you pay if you default.

Other than that, the application is good and has helped many people sort out their financial problems instantly.

Keep reading the blog, as I will update this review with more information.

Check out the rating section on different points that I think are useful.