Many people seeking a loan have asked about Tala’s loan application form in Kenya. If you are looking for a Tala loan application form online, This Article will help you find answers to your questions.

Tala is Kenya’s leading mobile loan provider that offers instant loans to qualified Kenyans. It has been active for quite some time, and many people, including me, think it is one of the best loan apps today.

Where to find Tala loan application form

If you are looking for a Tala loan application form online, there is none. All Tala loan application is through their mobile app.

Though when applying for a loan, there is a form you have to fill out to answer questions. This is a questionnaire they use to know more about your usage and what you plan to do with the loan.

This is the only Tala loan application form you will find; any other you can find online is fake, and you can avoid it.

Tala uses this information to grant your loan, and I will give an overview of all the questions asked on the Tala loan app.

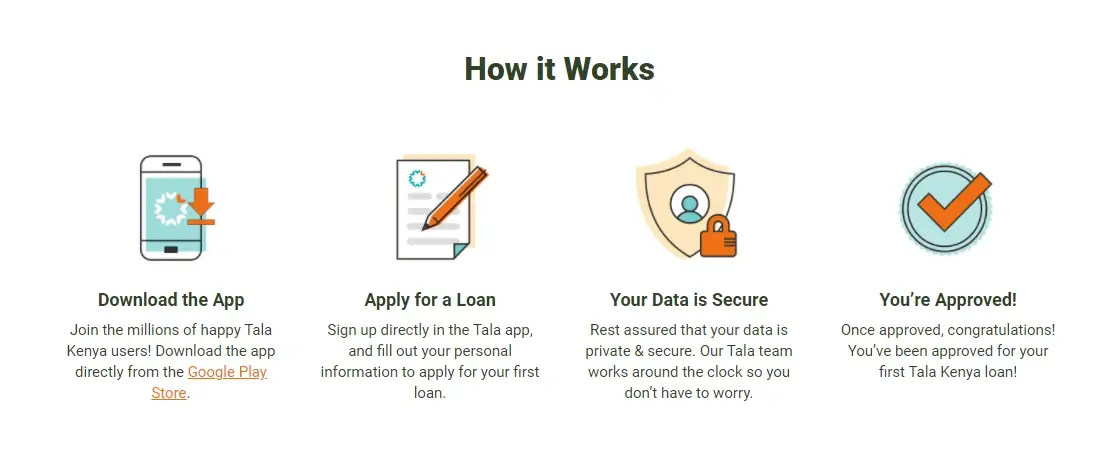

As you can see in the image above, there is no specific Tala application form online. Everything happens on the mobile app, which you can download from the Google Play Store.

Tala loan application form questions

Here are some questions asked on the Tala App before granting you a loan. I have briefly explained how to answer Tala loan questions.

- How did you use your last loan? Explain briefly how you used the loan; you can use one word: travel, shopping, school fees, etc. It is up to you.

- What would you like to use your loan for? – Select whether it is for business or a personal expense.

- What kind of Personal expense is this? – Here, you can select from Emergency, medical, education, travel, special occasion, or general expenses.

- If you selected business in the first question, you would be asked, What kind of business expense is this?

- Please describe how you will use this loan in more detail. – Give brief information on how you will use the loan. Remember that you have already hinted at the use in questions 2 and 3.

- Do you have outstanding loans? – Answer Yes or No.

When applying for the Tala loan, it’s advisable to answer these questions genuinely. This will improve your score and chances of qualifying for the following loan.

How to answer Tala loan questions

I see people online trying to give hints on answering Tala’s questions; I do not recommend it.

The reason is that your use for the loan differs from another person. There is no expert on matters of Tala’s loan application.

The best way to get a loan approved is by using the above information. It is important to note; that there is no tala online loan. All loans are provided via the Tala loan app.

Read Also: How to pay Tala loan in Kenya.

In Summary

Tala has no loan application form, so they use a questionnaire to determine your eligibility for the next time you apply. Be sure to answer all questions honestly and provide as much detail as possible about what you plan on using the money for. This will improve your chances of qualifying at the next go-around!