Living in today’s world means leveraging technology to make life easier. If you’re based in Nairobi and need to pay for international purchases, subscribe to services, or book hotels, a virtual dollar card is just what you need. Let’s dive into how to get one and how it can simplify your everyday life.

What is a virtual card and why do you need one?

A virtual card is a tool that allows you to make online payments without linking transactions to a physical bank card. These cards operate on Visa or Mastercard networks, meaning they’re accepted almost everywhere online payments are supported. For instance, you can use a virtual card to subscribe to popular apps, pay for ChatGPT, or book accommodations abroad.

Why are digital dollar payment cards becoming so popular among Kenyans? First, they’re convenient. Second, they help bypass restrictions that may arise with local cards when making international transactions. Third, they can be topped up quickly using cryptocurrency or bank transfers. Let’s break it all down.

How to get a virtual dollar card?

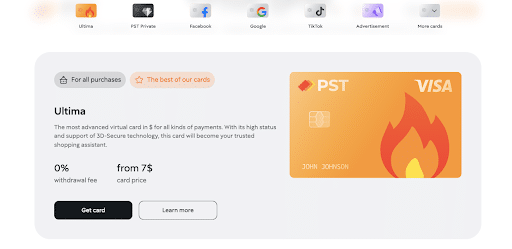

There are several platforms offering virtual cards today. One of the most suitable options for Kenyan residents is PSTNET, where you can issue a dollar card called Ultima.

To get a card, sign up on the PST.NET website. The process takes just a minute. You can register using a Google account, Telegram, WhatsApp, Apple ID, or simply an email address. The registration is straightforward and free of unnecessary requirements. Once logged into your account, you can issue a card with a single click.

How to top up your card?

The Ultima card can be topped up in various ways:

- Via bank transfers (SEPA/SWIFT).

- Using cryptocurrency. The platform supports over 18 types, including Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) in TRC20 and ERC20 networks.

For cryptocurrency, the process is simple: send the amount, and it’s automatically converted to dollars. The top-up information appears instantly in your dashboard. For example, if you have USDT in your wallet, you can transfer it to the card and use it immediately for purchasing apps, goods, or services.

Where can you use the card?

The card works wherever Visa and Mastercard are accepted. This means you can pay for subscriptions to services like Netflix, Spotify, or ChatGPT. It’s also perfect for booking accommodations through Airbnb or purchasing goods on international platforms like Amazon. But there are even more interesting use cases:

- Paying for online courses

You’ve decided to take a course on platforms like Coursera or Udemy. Local cards sometimes face restrictions from banks. A virtual dollar card allows you to pay for the course without delays or currency conversion hassles, especially useful if the course starts in a few days.

- Booking hotels abroad

Planning a trip? Booking accommodations online is fast and secure with a virtual card. Since it’s not linked to a physical bank, you don’t have to worry about funds being locked in case of a canceled reservation.

- Using Cryptocurrency

If you own cryptocurrency, the Ultima card becomes a convenient way to spend it. For example, you can pay for a ChatGPT subscription directly from your crypto wallet. The process takes minutes, with a top-up fee of just 2%.

Security and convenience

The Ultima card has no limits on spending or top-ups, making it ideal for users with diverse needs. The top-up fee is 2%, and there are no charges for withdrawals or operations on blocked cards.

Using the Ultima card is secure. Each transaction is protected with a 3D Secure protocol, sending you a special code via Telegram or SMS before confirming payment. Two-factor authentication adds an extra layer of security for your data. This is especially important for large purchases or storing funds.

Automatic cryptocurrency-to-fiat conversion and real-time balance updates in the dashboard make top-ups seamless. If you need multiple cards, the platform supports bulk issuance.

How to get started?

To get the Ultima card, start by registering on PSTNET. Then, issue the card, top it up using your preferred method, and use it as needed. There are no special requirements. If you have questions, contact PSTNET’s support team. They respond quickly via Telegram, WhatsApp, or the website’s live chat. This is especially helpful if you need clarification before making a payment.

Conclusion

A virtual dollar card is a tool that provides financial freedom and access to international services. For Kenyan residents, it’s a convenient solution for purchases, bookings, and subscriptions. The key is to choose a trusted platform like PSTNET and follow simple steps to get started. Try the Ultima card and see its benefits for yourself!