If you’re looking to buy Cryptocurrency in Kenya, there are a few things you need to know. First, Cryptocurrency is a digital currency that one can use to alternate fiat currencies. It has become popular because it offers many advantages over traditional currencies.

Cryptocurrency transactions are fast and irreversible and do not require third-party interference.

They are also anonymous, which means that they protect your identity and personal data from being stolen.

If you’re interested in investing in Cryptocurrency, you should know a few things.

- Cryptocurrency is a new and exciting asset class with much growth potential. However, it’s essential to understand the risks before investing any money.

- Investing in Cryptocurrency is risky, but there can be potential rewards for those who do so.

- Cryptocurrencies are decentralized and not subject to government or financial institution control.

- Cryptocurrencies are stored in digital wallets, and many different wallets are available. Be sure to choose a wallet that offers security features like two-factor authentication.

What is Cryptocurrency, and why should you invest in it?

Cryptocurrency is a digital or virtual asset designed to work as a medium of exchange. It uses cryptography to secure its transactions, control the creation of additional units, and verify the transfer of assets.

Cryptocurrencies are decentralized and not subject to government or financial institution control.

Why Invest in Cryptocurrency?

Cryptocurrency offers many advantages over traditional fiat currency, including:

- Decentralization – Cryptocurrency is not subject to government or financial institution control. This can offer increased protection from inflation and greater privacy and security.

- Anonymity – Cryptocurrency transactions are often anonymous, offering increased privacy for users.

- Security – Cryptocurrency is often more secure than traditional fiat currency, as it uses cryptography to secure its transactions.

- Low fees – Cryptocurrency transactions often have lower costs than fiat currency transactions.

Steps to Buy Cryptocurrency in Kenya

You should know a few things if you’re interested in buying Bitcoins in Kenya. Here’s a step-by-step guide on how to buy Cryptocurrency in Kenya.

Step 1: Choose a Cryptocurrency Exchange

The first step is to choose a cryptocurrency exchange where you can buy and sell cryptocurrencies.

A cryptocurrency exchange is a platform that allows you to buy and sell cryptocurrencies. Some exchanges also allow you to trade other assets, such as fiat currencies or commodities.

Several different exchanges are available, so it’s essential to compare them to find the right one.

When choosing a cryptocurrency exchange, there are a few things to look for, this includes:

- Supported currencies – Ensure the exchange supports the cryptocurrencies you want to buy.

- Payment methods – Does the exchange accept the payment method you want to use?

- Fees – Compare the prices charged by the exchange.

- Security – Does the exchange have an excellent reputation for safety?

- Location – Some exchanges only operate in certain countries. Make sure the exchange you choose works in your country.

Some well-known cryptocurrency exchanges in Kenya include Coinbase, Etoro, Paxful, Binance, and Kraken.

Step 2: Create an Account and Verify Your Identity.

Once you’ve chosen an exchange, you must create an account and verify your identity.

This usually involves providing personal information, such as your name, email address, and phone number.

You may also need to provide documentation, such as a copy of your National ID, passport, or driver’s license.

Step 3: Deposit Funds

Once your account is verified, you must deposit funds into it. This can be done using various methods, including bank transfer, credit/debit card, or wire transfer.

Step 4: Select a Cryptocurrency to purchase

Now that you have funds, you’re ready to purchase a cryptocurrency. Most exchanges will allow you to buy multiple cryptocurrencies to spread your investment across different coins. The following are some of the most popular cryptocurrencies in Kenya.

Step 5: Start Trading!

Now that you know how to buy Cryptocurrency, it’s time to start trading. Cryptocurrency trading is similar to forex trading, where you buy low and sell high—however, there are a few things to consider, such as market volatility and transaction fees.

When buying Cryptocurrency, always remember to invest responsibly and research before making any decisions.

This is not financial advice.

Step 6: Withdraw Your Cryptocurrency

Once you’ve bought Cryptocurrency, you can withdraw it to a personal wallet. This process varies from exchange to exchange but usually involves selecting the “Withdraw” option and specifying the amount and wallet address.

Where to Buy Bitcoin in Kenya.

Now that you know how to buy Cryptocurrency in Kenya, let’s look at the four best exchanges for buying Bitcoin.

1. Coinbase

Coinbase is one of the most popular cryptocurrency exchanges and allows you to buy Bitcoin with a bank transfer, credit/debit card, or wire transfer. The site also has Coinbase Pro, which offers lower fees and more features for advanced traders.

2. Binance

Binance is a popular cryptocurrency exchange that offers many assets, including Bitcoin. The website also has a Binance US feature, only available to US citizens.

3. Kraken

Kraken is one of the oldest and most popular cryptocurrency exchanges. It offers a wide range of assets, including Bitcoin, and allows you to buy with a bank transfer, credit/debit card, or wire transfer.

4. Paxful

Paxful is a peer-to-peer (P2P) exchange that allows you to buy Bitcoin with various payment methods, including PayPal, bank transfer, Mpesa, or cash.

5. eToro

eToro is a social trading and investment platform that offers many assets, including Bitcoin. eToro also has a feature called CopyTrader, which allows you to copy the trades of other users.

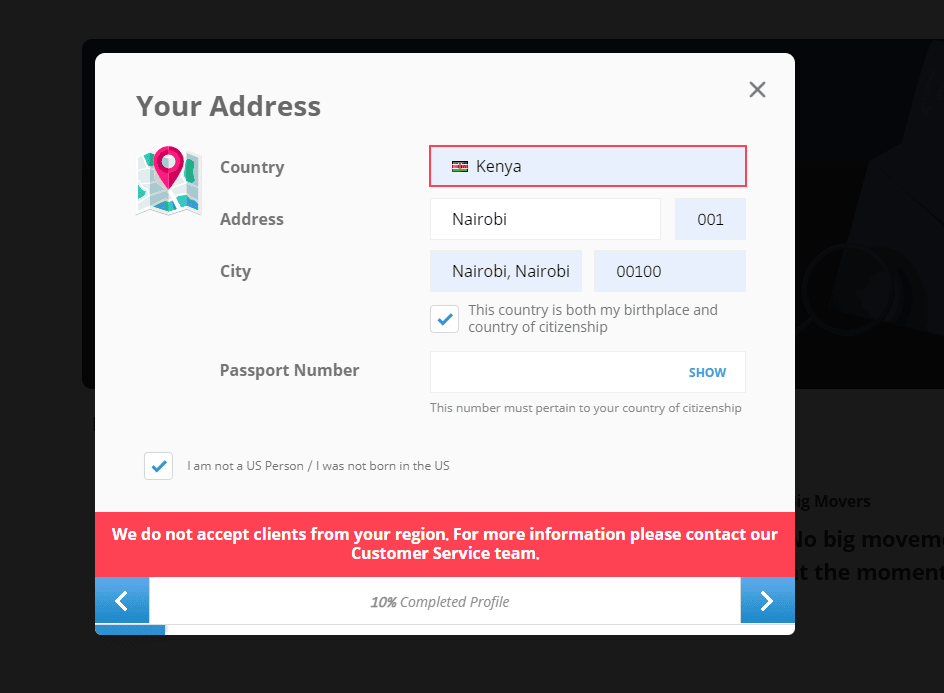

We noticed that they didn’t accept people from Kenya when we checked.

6. LocalBitcoins

LocalBitcoins is a P2P exchange that allows you to buy Bitcoin with various payment methods, including Mpesa. It is important to note that LocalBitcoins does not offer escrow services, so you must be careful when choosing a seller.

These are just a few of the many cryptocurrency exchanges available. Do your research before choosing an exchange, and never invest more than you can afford to lose.

FAQs on how to buy Cryptocurrencies in Kenya

1. What is the minimum amount to invest in Bitcoin?

There is no minimum amount to invest in Bitcoin. However, it’s important to remember that cryptocurrency markets are highly volatile, so you should only invest what you can afford to lose.

2. Is buying Cryptocurrency in Kenya legal?:

According to a public notice by the Central Bank of Kenya issued in December 2015, Cryptocurrencies such as Bitcoin are not legal tender in Kenya. Therefore, no protection exists if the platform that exchanges or holds the virtual currency fails or goes out of business.

How do I start investing in Cryptocurrency in Kenya?

Consider a few things if you’re interested in investing in Cryptocurrency. First, always remember to do your research. Second, only invest an amount that you can afford to lose. And finally, diversify your portfolio.

1. Research.

As with any investment, it’s essential to do your research before investing in Cryptocurrency. Make sure to read up on the different types of Cryptocurrency and the other exchanges available.

2. Only invest what you can afford to lose.

Cryptocurrency markets are highly volatile, which means that prices can change quickly. For this reason, investing only an amount you can afford to lose is essential.

3. Diversify your portfolio.

One of the most important things to remember when investing in Cryptocurrency is diversifying your portfolio. Don’t put all your eggs in one basket; don’t invest more than you can afford to lose.