The following article discusses the strongest currencies in Africa. It contains information about their current exchange rate and briefly describes each currency’s success and history.

The African continent is home to many countries with unique cultures and economies. This article will look at some of the more successful currencies across the region than the US dollar.

Related: List of the Highest Currencies in Africa.

List of the Strongest Currencies in Africa

Here is a list of the ten Strongest Currencies in Africa:

1. Tunisian Dinar

- Currency Code: TND

- Exchange Rate in the Current Market: $1 = 2.86 TND

- Inflation Rate in: 5.6%

- GDP per capita is USD 10,590

The Tunisian Dinar has been a currency unit since 1964 and is currently pegged to the US dollar at a fixed rate of $: 2.86 TND.

It was first introduced to the country in 1885 during French colonization and replaced a system of pounds, shillings, and pence used since 1891 as part of British colonial rule.

The Tunisian Dinar is the strongest currency in Africa and one of the best-performing currencies globally.

It ranks first for being most stable against foreign inflation rates and having low volatility compared to other currencies.

2. Libyan Dinar

- Currency Code: LYD

- Exchange Rate in the Current Market: $1 = 4.59 LYD

- Inflation Rate: 7.47%,

- GDP per capita: 11,100 USD

They introduced the Libyan Dinar to Libya after its independence from Italy in 1951. The country was under French and British control following the unification of North Africa by Italy through treaties with France, Britain, and Spain, who invaded Tunisia.

The Libyan Dinar is one of the strongest currencies in Africa and ranks second for being most stable against foreign inflation rates. It has a relatively low volatility index compared to other countries.

They currently peg the Libyan Dinar to the US dollar at a fixed rate of $0.22.

However, in 2011, it dropped from nearly $0.46 when NATO forces backed rebels he had been printing money, which caused inflation rates to rise drastically around 2010-2011, ousted and killed Gaddafi.

The currency has also seen exponential growth since 2011, with a current market exchange rate roughly 40% higher than it was five years ago (during Gaddafi’s rule).

3. Ghanaian Cedi

- Currency Code: GHC

- Exchange Rate in the Current Market: $1 = 6.12 GHC

- Inflation Rate: 9.89%

- GDP per Capita: $7,210 USD

The Ghanaian Cedi is one of the strongest currencies in Africa and ranks third for being most stable against foreign inflation rates.

Currently, one Ghanaian Cedi (GHS) exchanges for about $0.16, making it an affordable option compared to other major currencies while also being a widely used means of payment throughout all regions of Africa.

The Cedi has seen exponential growth since 2011, and Ghanian finance minister Kwesi Botchwey stated that “the cedi’s strength against the dollar has been a key factor in the country’s current account performance and foreign exchange reserves accumulation, which have risen to $43 billion.”

The Cedi was one of only two African currencies that had not seen an appreciating trend against the US Dollar until recently (Nigeria’s Naira). Still, it has since appreciated by 40%.

Also, read Richest Countries in Africa Per Capita.

4. Moroccan Dirham

- Currency Code: MAD

- Exchange Rate in the Current Market: $1 = 9.18 MAD

- Inflation Rate: 1.4%

- GDP per capita: $8,030 USD

The Moroccan Dirham has seen exponential growth since 2011, when King Mohammed VI came into power and introduced free-market reforms that helped grow economic stability.

The Moroccan government is also heavily involved in the mining industry and has one of the largest phosphate reserves worldwide; Morocco exports most of its supply to China.

The country ranks second as a leading exporter of phosphates, uranium ore, and car parts.

The country also has robust economic control, and the IMF states that the “fiscal stance is likely to remain tight in 2020 and 2022.”

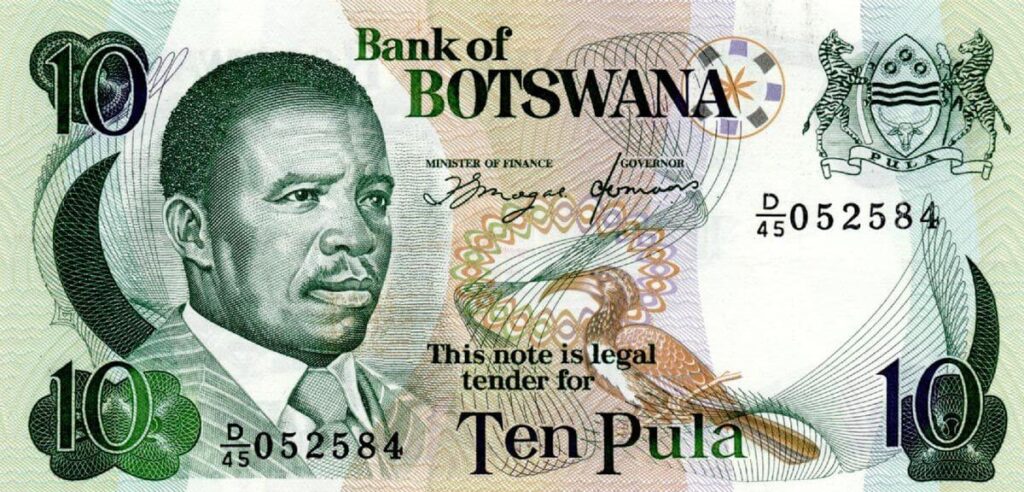

5. Botswana Pula

- Currency Code: BWP

- Exchange Rate in the Current Market: $1 = 11.57 BWP.

- Inflation Rate: 6.67%

- GDP per Capita: 18,110 USD

The name “pula” means rain, which comes from a Khoisan word meaning “to scatter seeds” or “rain shower,” which became popular in Botswana.

Botswana is one of the most stable currencies in Africa and ranks fifth for being the least volatile against foreign inflation rates.

The pula has shown a shallow volatility index, meaning there is little to no fluctuation in its market exchange rate compared with other countries currencies on average.

This makes it relatively easy to plan and manage foreign exchange risk. However, it had seen exponential growth since 2010, when Botswana’s diamond exports increased by nearly 20%.

The country now accounts for roughly half of all diamond production globally and earns approximately $900 million annually.

The Botswana government is also relatively well funded and has one of the highest GDPs in Africa, at $53 billion.

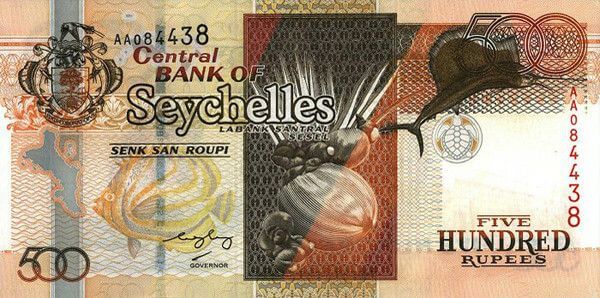

6. Seychellois Rupee

- Currency Code: SCR

- Exchange Rate in the Current Market: $1 = 13.43 SCR USD

- Inflation Rate: 9.96%

- GDP per Capita: $26,120

We formerly knew the Rupee as the group and have used it since 1903, when the British colonial government introduced it.

They pegged the Rupee to the US dollar at a fixed rate of $: 0.023 SCR; however, it had seen exponential growth since 2017, when Seychelles had its first general election in five years and changed its currency from groups (SCR) to Rupee (SCR).

The country enjoys a tropical climate with abundant fishing waters and beautiful beaches, so fishing and tourism have become the primary source of income for many Seychellois people.

Over the past few years, the country’s economy has been strong due to substantial investments in tourism, oil refining, and mining industries. This has helped keep inflation low while maintaining economic growth at around five percent per year.

See also Most Developing Countries in Africa.

7. South African Rand

- Currency Code: ZAR

- Exchange Rate in the Current Market: $1= 15.60 ZAR

- Inflation Rate: 3.27%

- GDP per Capita: $12,440 USD

The Rand was formerly known as the Pound and has been used since 1961. It replaced several other currencies, including South African, North Rhodesian, and Transvaal Rhodesia.

South Africa has had a strong economy due to its diversity, making it less vulnerable to global shocks than other African countries.

Furthermore, the South African Reserve Bank has been working on inflation targeting, which has helped maintain its value and prevented high volatility.

The Rand is also easy to exchange internationally or locally within South Africa, making it a strong contender as one of the best currencies that no one knows about.

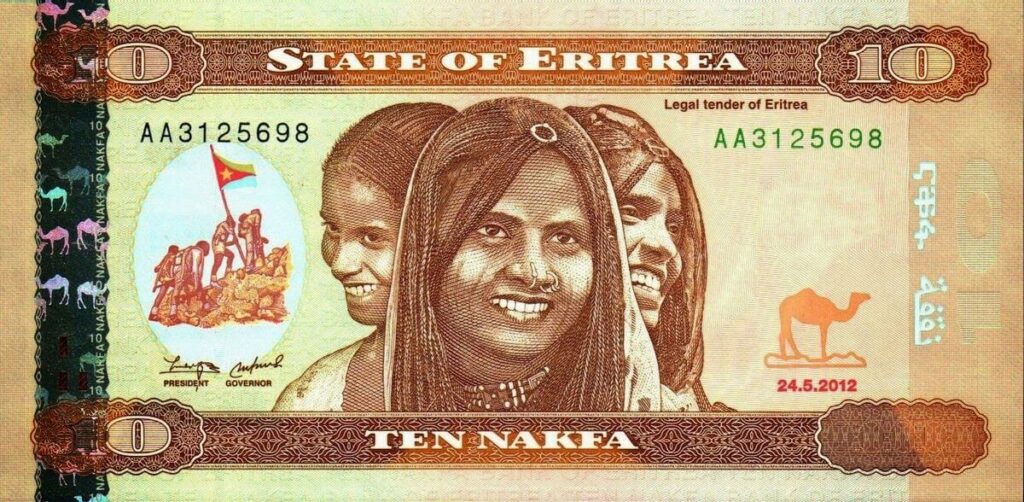

8. Eritrean Nakfa

- Currency Code: ERN

- Exchange Rate in the Current Market: $1 = 15.00 ERN

- Inflation Rate: 8%

- GDP per capita: 13,200 USD

The Nakfa was formerly known as the lire and has been used since 1997, when it replaced the birr.

The Nakfa is one of the most steady currencies on this list, ranking eighth for being least volatile to foreign inflation rates; nevertheless, recent political events have caused volatility in its market.

The Nakfa is also one of Africa’s most liquid fund assets and can be used worldwide for international payment; Eritrean citizens can hold multiple currencies, making it a strong contender as an investment vehicle that no one knows about.

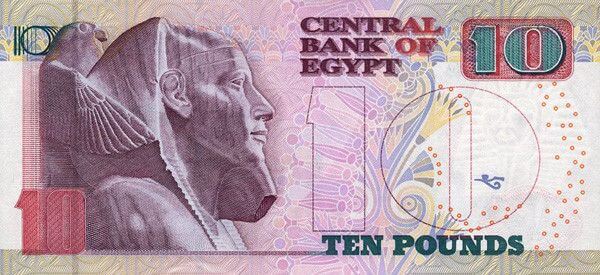

9. Egyptian Pound

- Currency Code: EGP

- Exchange Rate in the Current Market: $1 = 15.69 EGP

- Inflation Rate: 20.85%

- GDP per Capita: 13,080 USD

We formerly knew the Pound as the lira. They had used it since 1834, when it replaced several other currencies, including the Egyptian piastre, Indian Rupee, and Maria Theresa thaler.

Egypt has had a solid economic recovery since the political turmoil that shook its economy over recent years, with inflation reduced from more than 30 percent to less than ten percent.

Furthermore, the Central Bank of Egypt has been working on reducing public debt and strengthening its foreign reserves, which have helped maintain a stable economy.

10. Zambian Kwacha

- Currency Code: ZMK

- Exchange Rate in the Current Market: $1 = 17.59 ZMK

- Inflation Rate: 16.35%

- GDP per Capita: 11,500 USD

We rank the Kwacha tenth as one of the most stable currencies.

We formerly knew Zambia as Northern Rhodesia and have used the kwacha since 1964, when it replaced several other currencies, including the Zambian Pound, Rhodesian dollar, and South African Rand.

Zambia also had a high GDP of $20 billion. It ranked as the least-developed country in Africa, with an average life expectancy of 60 years old, making it the last on this list for the human development index (HDI).

You may also like; Tallest Buildings in Africa.

Conclusion

The African continent has many currencies in that people purchase goods and services.

However, the strongest economies in Africa with the most stable currencies are South Africa, Egypt, Tunisia, and Zambia. These countries rank high in their GDPs and HDI, making them the most stable African currencies.

However, Egypt has recently devalued its currency because of political issues plaguing its markets and low inflation rates, which are expected to rise over time, meaning it is not one of the best currencies.

Egyptians can hold multiple forms of currency, making them an easy target for investment vehicles that no one knows about.

Zambia’s currency ranks tenth because of its stability. Still, it has recently devalued, making it not one of the best currencies in terms of strength and marketability.

South Africa ranks high because of its stability and GDP but has a low HDI, making it less intense than other currencies in terms of marketability and strength.

The strongest currencies in Africa are not necessarily the ones everyone knows about. To determine which money is solid, we look at various factors, including inflation rate, GDP per capita, and life expectancy, to ensure that individuals living within each country can enjoy relative stability and freedom.