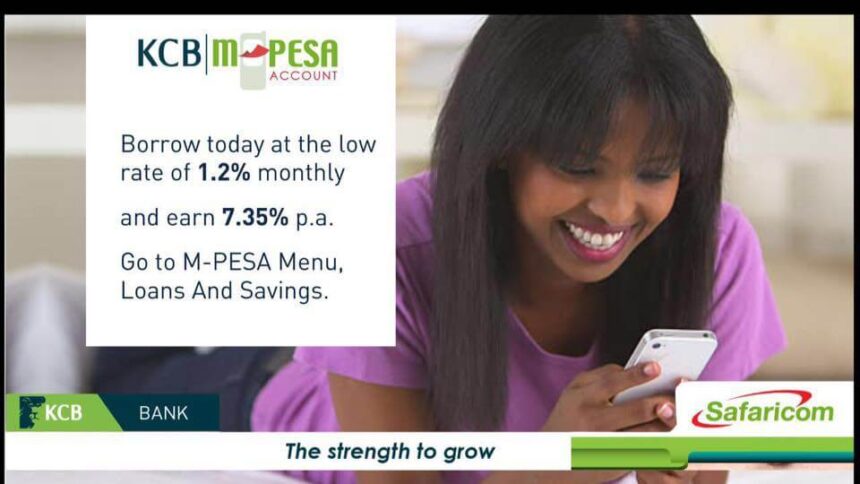

The KCB MPESA Loan product is a partnership between the Kenya Commercial Bank and Safaricom PLC. They allow Kenyans to access loans from as low as Ksh 1,000 and payable in a month. In this article, we will tell you all you need to know about this amazing loan product.

With the mobile-based account Safaricom’s customers can access instant loans at low-interest rates of 1.16% per month with a one-off negotiation fee of 2.5%.

The customers can transfer money in and out of their accounts for free and save their money in the KCB MPESA accounts. i.e., Fixed Deposit Account or the Target Savings Account and earn interest of up to 7.5% p.a.

KCB MPESA Account Benefits

The following are the benefits of the KCB MPESA account:

- Borrowing can be done immediately without saving.

- Loan Disbursement is through the KCB MPESA Account

- You can choose flexible loan repayment periods of 1 month, three months, and six months.

- The interest on savings is at 2% p.a.

- Personal accident insurance benefit based on savings

- Savings and withdrawals are easily made through either the MPESA menu, KCB Mobi, or KCB Mtaani Agent

- The minimum amount one can save is KES 1 with a maximum of KES 1 million

Eligibility

To open an account, you will need to have the below requirements:

- National ID, Military ID, Kenyan Passport, Diplomatic ID (Registered on IPRS), or Alien ID.

- Be a registered Safaricom MPESA customer.

- An active MPESA account.

How to Open a KCB MPESA Account?

- On your Safaricom phone, dial*844#.

- Accept the Terms and Conditions.

- KCB will send an SMS to you containing your PIN.

- Dial *844# again and enter the PIN to access your account.

Types of KCB MPESA Accounts

1. Fixed Savings Account

This account allows you to lock a specific amount of cash for a certain period.

Features

- No top-up is required once the amount is saved.

- Loan limits periods include 1, 3, 6, and 12 months with the minimum amount of KES 50

- All interest accrued is forfeited upon early or premature withdrawal

- You also get a Life insurance benefit based on fixed deposit savings.

2. Target Savings Account

This account allows you to set a saving goal or target and make deposits towards achieving that target.

Features

- Requires continuous contributions to achieve your target.

- The account is accessible with standing orders from MPESA or KCB MPESA Account.

- Varying interest rates which depend on the loan repayment period, i.e., one month (3%), three months (4%), six months (5%), and 12 months (6%)

- Cumulative interest

How to Request a KCB MPESA Loan?

To request a loan:

- Dial *844# and enter your secret PIN.

- Select “Loan” followed by “request loan” and enter the amount you wish to borrow.

- Select the preferred loan repayment period (1, 3, or 6 months).

- Upon approval, KCB MPESA will transfer funds to your KCB MPESA Account.

How to Repay my KCB MPESA Loan?

You can repay the KCB loan in full or installments through the KCB MPESA or MPESA accounts. To repay your loan.

- Dial *844# and enter your secret PIN.

- Select the “Loan” menu followed by the “Pay loan.” menu option

- Select payment from either the KCB MPESA account or MPESA.

- Enter Amount to pay and follow the system prompts to complete your transaction.

How to Send Money from MPESA to your KCB Account:

These steps below show you what is to be done to transfer money from MPESA to your KCB account

- Go to MPESA

- Payment Services

- Pay Bill

- Enter 522522 as the Business Number

- Enter Your KCB Acc No.

- Enter the Amount to transfer

- Enter Your MPESA pin

Good and reliable

[email protected]