When it comes to writing a cheque, there are specific things you need to include for the payment to go through. In this step-by-step guide, we’ll show you how to write a cheque correctly so that there are no issues with your payment.

By following these simple steps, you can make sure your money reaches its destination quickly and easily. So, let’s get started!

A cheque is a document that orders one’s bank to pay another person or organization. Cheques are like cash because the funds are taken from your account immediately.

They’re also like credit cards because you can write a cheque against the money you don’t yet have, but unlike credit cards, if the amount of money in your account isn’t enough to cover it, there will be an overdraft fee charged by the bank.

Read also: Top 10 Money Transfer Companies

How to write a Cheque in Six Simple Steps

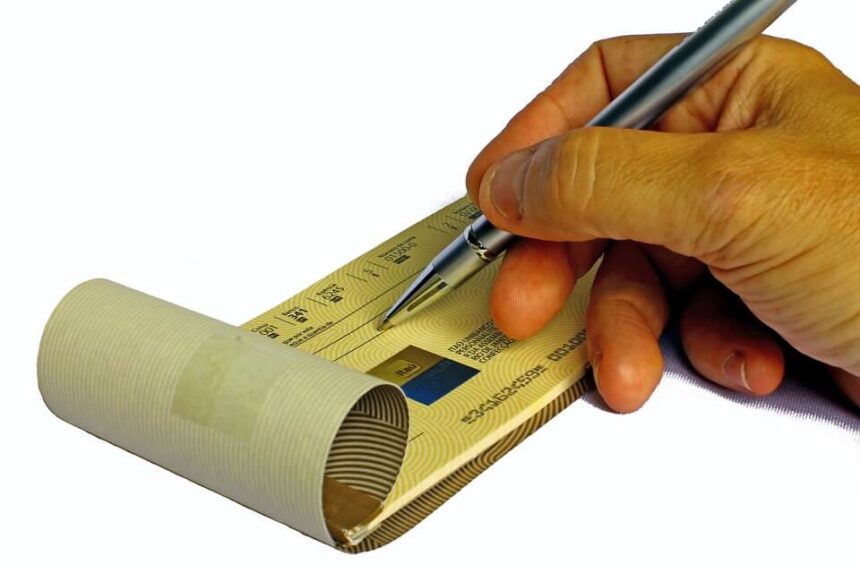

You can write a cheque by following these easy steps:

Before you begin, make sure that you have the correct payee information on the front of your cheque.

1. The date should be written in the top right corner of your cheque. Month, day, and year are written in numerals. If it’s Feb 09, 2022, your cheque should say “Feb 09, 2022.”

2. Next, on the line that says “Pay to the Order of.” write the name of the person or organization you are paying. For example, if you’re buying groceries at Smith’s Grocers, write “Smith’s Grocers” in this section.

3. Underneath the payee’s name, write how much money you are paying them in words. For example, if you’re writing a check for $2.56, write “two dollars and fifty-six cents” in this section.

4. Write the numerical amount of money you are paying next to the dollar sign. For example, if you’re writing a cheque for $2.56, write “$2.56” in this section.

5. The memo section can be used to write short notes. For example, if you’re writing a cheque for groceries, put the type of groceries in this section so that they’ll know what’s owed to them when you go to cash your cheque back at the grocery store.

6. Finally, sign the cheque above where it says “Signature.”

Writing a cheque is quick and easy. You can pay someone in person, or you can use an online bill payment service to make paying bills even more effortless!

Read also How to Send a Large Amount of Money to Someone.

Here are a couple of things that you should know about writing a cheque:

- You should always keep a list of the cheques you have written and their information in a cheque register to reconcile your bank statement at the end of each month.

- To prevent fraud, it’s important to sign your cheques. If your signature is easy to copy or seems rushed, people may use it fraudulently.

- A cheque that doesn’t have enough money in your checking account to cover the amount of money you’re writing is considered an overdraft and will be charged a fee by the bank.

- Cheques are drawn on the U.S. (and the U.K.) banks can be cashed with small or no fee at any bank in the U.S. or U.K. member of the Clearing House Interbank Payments System.

- Writing a cheque with someone else’s name on it is considered cheque fraud under U.S. law and can result in imprisonment for up to 30 years if the amount of the check was $1 million or more.

Top FAQs on How to write a cheque

Question 1: Is there a limit to how many cheques I can write?

Most banks only allow you to write a certain number of cheques per month, but you should always check with your bank before writing out any significant number of cheques.

Question 2: Is there a limit to how many cheques I can cash simultaneously?

There is no limit in most cases, but when it comes to cashing cheques from the same bank using the same bank account number, your bank may place limits on how much you can cash. You will have to check with your bank for details.

Question 3: Can I take my time in cashing a cheque?

No. Money is taken from your checking account immediately when you write out a cheque, so if there isn’t enough money in your account to cover the amount of money on the cheque, your bank will charge an overdraft fee.

Question 4: How do you write a cheque to yourself?

To write a cheque to yourself, you need to write a cheque from one of your accounts. For example, if you have a checking account and a savings account set up with the same bank, if you wrote a cheque on your checking account for money in your savings account, it’s considered writing yourself a cheque.

Question 5: What if I wrote a cheque and forgot to sign it?

If you forget to sign your cheque, the bank will likely not allow you to cash it. A cheque to be considered valid needs a signature from both the payee and the person writing the cheque.

Question 6: What is a stop payment?

You can place a stop payment on any cheque that hasn’t cleared your bank yet. If you place a stop payment, it won’t cost you anything but the fee to write out the bad cheque.

Read also: Top 10 Money Transfer Companies

Conclusion:

To write a cheque, you’ll need to get a checking account from a bank or credit union. You can then use your checkbook register to keep track of all the information necessary for writing out a cheque. From there, it’s quick and easy!